Salary Of A CFA In India? CFA (Chartered Financial Analyst) is currently regarded as one of the most sought-after and highest-paying professions in the financial sector. The scope of CFA and pay in India are examined in depth in this article.

Salary Of A CFA In India

This career, despite the good pay it offers once you finish your degree, involves a lot of reasoning and difficult ideas that demand devotion and maximum concentration. Probability, statistics, mathematics, investment, portfolio management, economics, security analysis, investments, Corporate Finance, and so on are some of the topics covered. Chartered Financial Analysts students can expect to work in the following areas:

• Business Analytics

• Risk Management

• Research analysis

• Auditor

• Portfolio Manager

• Financial Advisor

• Accounting and Finance

• Investment Banking

• Executive

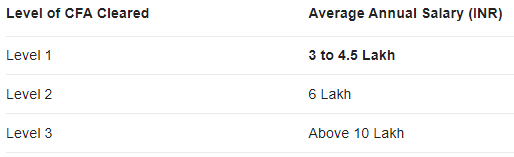

Three levels of examinations are required to become a CFA Charter holder.

- Portfolio management techniques, asset valuation, financial reporting, and analysis.

- Quantitative methods in asset valuation.

- Equity, derivative investments, asset valuation models.

A large number of people are attempting to establish their careers in it without having a basic understanding of it. They frequently feel stuck due to a lack of knowledge. According to the data, just 43% of candidates were able to pass all of the examinations. Furthermore, to apply for them, you must have a bachelor’s degree. To become a certified expert, you must have at least four years of financial experience.

The ‘CFA Charter’ is awarded to those who complete the programme successfully, and major consulting companies such as JP Morgan, Goldman Sachs, Royal Bank of Canada, and Morgan Stanley frequently recruit CFA Charter holders.

The main purpose of this post is to go into the pay possibilities for a CFA or CFA average salary if you choose to work as a CFA. Let’s start with a few elements that impact any employee’s compensation, not only CFA salaries.

Industry Condition

When you work in a business, your pay is determined by how profitable the business is. If the sector is not profitable, no matter how hard you work, you will not be paid more, which will have an impact on your CFA income.

Globalization

CFA pay is also affected by where you reside and the consequences of globalisation. Globalization refers to cross-regional trade that has an impact on enterprises.

Unemployment

People become unemployed because they lack relevant abilities, which will assist you find a job that requires such skills.

Demand in a particular area

CFA compensation is also determined by how many experts are in demand or how much the firm is ready to pay in light of the industry’s growth.

Basic pay, cash bonuses, and equity make up an employee’s total income.

The following CFA pay study is based on examining this profession with many criteria rather than comparing it to all other professions.

Experience

Even after completing such a difficult degree, students frequently find themselves in low-paying jobs owing to a lack of on-the-job experience. The degree covers a wide range of topics such as probability, statistics, mathematics, investment, portfolio management, economics, security analysis, investments, Corporate Finance, and so on.

These abilities are meaningless unless you understand their consequences in the most imaginative way possible. When you first start working in a field, you will be confronted with a large number of obstacles and dangers, which will test your capacity to deal with them.

According to data, once you reach your mid-career, you have a good probability of earning a good wage. Again, gaining a significant quantity of expertise in this sector is difficult. Because so many people choose to work in this profession, competition is fierce. Only 6.1 percent of CFA grads in India are consistent and have the highest degree of experience, resulting in a higher CFA pay.

Statistics show that some people change careers owing to the wide range of interests and devotion required in this profession. If you stay consistent in your profession, your competitors will ultimately fade away.

Because there are few experienced experts available, the typical CFA pay is usually expensive. The specialists are paid well and undertake a range of jobs. With an appropriate number of 5-9 years experience, a fresher may start with a package of approximately 4 lakhs, which may be increased to 15-20 lakhs.

Job Type – Salary Of A CFA In India

The job type is another factor that influences the CFA average pay. With a CFA degree, graduates can work in a number of roles. The following are the key profiles that will be considered:

• Portfolio manager

• Financial Analyst

• Research Analyst

• Chief executive

According to data, among the various job descriptions, the portfolio manager earns the most money. The portfolio manager’s work include coming up with investing ideas and putting them into action. According to CFA Institute data from 2018, over 22% of CFA charter holders work as portfolio managers in various sectors. Following that is the Research Analyst profile, which ranks second among the other CFA charter roles.

A research analyst’s work includes presenting and interpreting data in order to make marketing, economic, and customer-related choices. In the role of a Research Analyst, almost 15-16 percent of CFA charterholders work globally. Because chief-level executives have such a broad profile, the average CFA Salary In India varies from year to year.

Some applicants have the position of Chief Financial Officer, while others hold the position of Chief Investment Officer. As a result, it’s difficult to determine if the CFA salary of this profile has increased or decreased. According to data from the CFA Institute, just 7% of CFA Charter holders become Chief Executive. Many more positions exist, such as Risk Managers, Consultants, Auditors, and Advisers, although their starting salaries vary based on their expertise and industry. These aspects will be discussed more in this article.

Cost of Living

The candidate’s CFA Salary In India is heavily influenced by the location in which he or she lives while working in that area. Compensation refers to money or bonuses paid to employees in addition to their regular wage. Employees in high-cost-of-living cities are frequently paid significantly more than those in smaller areas.

Living in a place like New York, which has a relatively high cost of living, is extremely costly on a global scale. CFA charter applicants in India earn less money than those in the United States. Popularity in a specific location is really important. In comparison to the United States, the CFA job is less popular in the United Kingdom.

Despite the high cost of living and lower pay, the majority of CFA charters work in New York. Salary growth in India is lower than in other industrialised nations such as the United States and the United Kingdom, but it is sufficient depending on the cost of living.

Industry – CFA Salary In India

The industry in which a CFA charter works has a significant impact on the CFA average pay. The following are some of the industries where the CFA charter is commonly used:

• Insurance and Financial Services

• Banking

• Wealth Management

• Investment services

It is frequently observed that the average CFA pay in various sectors differs just little. However, when we look at it in a larger context, the CFA Institute claims that CFA charter holders in the Insurance Services and Banking businesses are paid more than those in other areas. Professionals in these fields have a lot of work to do, therefore they are paid more.

There is a lot of rivalry among candidates because of the high pay range and good quality job. Within areas like wealth management and investment services, there isn’t much of a variation in CFA salaries. CFA charters are also well compensated in certain sectors. Insurance and banking are the most lucrative profiles due to a minor distinction. The wages of CFA charterholders working in these areas are nearly identical to the CFA average salary.

Degree

Students from many walks of life are likely to begin their careers as CFA charter. Below is a list of the most frequent degrees.

• MBA Finance

• BA

• BSc

• BBA

Let’s take a look at two things before we go into their pay structure and bonuses. In this section, we’ll discuss

a) pay increases after obtaining a certain degree and

b) the starting wage for a CFA.

CFA SALARY IN INDIA

In comparison to other degrees, candidates who complete an MBA finance start with a large compensation package. Students in BA, BSc, and other under-graduate programmes begin with a low salary, but as they gain experience and expertise, their pay scale rises to that of an MBA graduate.

In India, students with a BA degree have a better chance of earning more money than those with other degrees. Comparing MBAs, BBAs, and other degrees is pointless since after 4 to 9 years of experience, you will be on a nearly same platform. The average CFA pay remains consistent in these areas, however it may vary based on the candidate’s talents and the company’s need.

Final Thoughts

As a result, the in-depth research we conducted on the CFA Salary In India, which took into account all factors, yielded a number of results. Being a CFA charter holder will never let you down since it not only pays well but also exposes you to a wide range of complicated topics that sharpen your mind. If you enjoy dealing with complicated reasoning on a daily basis, this may be your ideal job.

As the study shows, having experience adds a lot of weight to your resume and helps you land a high-paying job. Having real work experience, regardless of your background, will assist you in landing your ideal career. Even MBA students in finance are more likely to begin their careers in Chartered Financial Analysis.

No matter what field you work in, a CFA pay is determined by your experience, abilities, and the company’s need.

It has also been shown that the quantity of experienced professionals has an impact on a profile’s CFA average wage. Candidates working as profile managers, for example, earn the most compared to other profiles because there are only a few skilled portfolio managers accessible worldwide. The majority of the applicants end up working as research analysts.

Your income and advancement are heavily influenced by your experience and the industry in which you work. A CFA charter is focused on the financial industry. Chartered Financial Analysis is a difficult subject to master. Within a statistical framework, Chartered Financial Analysis is an excellent alternative for finance lovers who like working with complicated data on a daily basis. Furthermore, individuals have the patience to get a significant quantity of expertise in this sector. Typically, a large number of people try to settle their career in it without having a clear understanding of it. They frequently feel trapped due to a lack of knowledge.

While studying for the CFA, you may have a lot of unanswered questions. As a result, an online platform like Press-Wire becomes critical for students, where they can obtain answers to all of their questions from specialists all across the country. All you have to do is register on the website. Ask professionals with outstanding academic records and experience to clarify your questions.

There are no fields that are better than others; it all relies on your personal interests and ingenuity. You are simply expected to be good at whatever you do, rather than choosing something fancy out of curiosity and never being good at it.

Hope this article answers ‘What is the Salary of a CFA in India.

FAQs

CFA Salary in India

A Chartered Financial Analyst (CFA) earns an average income of $62,300 a year (36,960 per month), which is $2,94,800 (+76%) more than the national average salary in India. The average starting pay for a Chartered Financial Analyst (CFA) is $392,500. The best paid employees can earn up to $16,000,000.

They need strong financial abilities and a thorough understanding of financial principles, as well as sales ability to raise funds. This is why India has a high need for CFAs.

Because there are few experienced experts available, the typical CFA pay is usually expensive. The specialists are paid well and undertake a range of jobs. With an appropriate number of 5-9 years experience, a fresher may start with a package of approximately 4 lakhs, which may be increased to 15-20 lakhs.

China (19,598 people)

USA (12,126 people)

India (6,889 people)

Canada (4,392 people)

UK (4,367 people)

Australia (3,357 people)

Hong Kong (2,289 people)

Singapore (1,379 people)